Is your Business Ready to Accept Online Payments?

Paragraph

As a business owner, you must be excited to start marketing and leading customers to your products. One of the last, but not least, is to find an Online payment solution that best suits your business on all levels.

Many shoppers leave websites without paying due to a shortage of payment options or an inability to follow the checkout process. Which makes having a great Gateway to follow through, priceless.

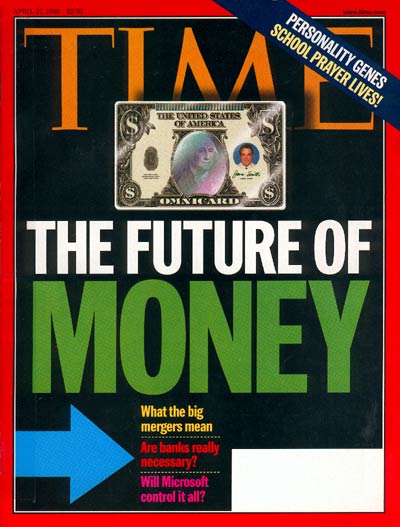

Doing Business In A World With No Money

We’re living in an increasingly cashless world. That’s great news for many businesses that benefit from impulse purchases, shorter processing…

Big Business Eating Your Lunch? Beat Them on Customer Care

Amazon delivers the same day – Walmart has the carts full from an online order – Big Lots discounts below…

Help for the Holiday Chargeback Hangover

As the last weeks of the holiday season pass and the receipts total up to a good, or even great…

Getting CBD Payment Processors Approved

With the easing regulatory atmosphere for cannabis related products, the business community has been somewhat slower to feel secure in…

6 Best Practices for Non -Profit Organizations in Setting Up Online Donations

Choose a payment processor who understands the unique needs and operations of non-profit organizations. Many payment processors work almost exclusively…

Boost Your Business By Accepting Online Payments via ECheck

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] There are three ways that checks do their job of taking money from your account…

NEW TECHNOLOGY CLOVER STATION PUTS YOU IN CONTROL OF YOUR BOTTOM LINE

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] Bring your business into the 21st Century with the operations management Clover Station system. It…

Get Paid NOW! – Fast and Secure Mobile Payments

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] Whether you’re an artist at a show, a handyman on the job, a wedding singer,…

Starting a Business – Capital and Expertise are Key Ingredients

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] The internet has made the process of starting a new business easier than ever. Gone…

Accepting Online Payments for New or High Risk Businesses

So you’ve started a new business either online or in the real world. You have a great product or a…

Choose Your Credit Card Processing Company With Great Care

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] Choosing a solid credit card processing company is one of the most important challenges in…

6 Ways to Reduce Chargebacks

With your merchant account in place, the online payments flow in and business booms, but with this new way of…

How to Choose a High Risk Provider

It is all but impossible in today’s economy to operate a business without accepting payments other than cash. For most…

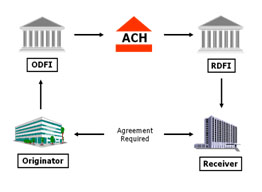

Benefits of Accepting ACH Payments

ACH payments are responsible for $43 trillion and 25 billion electronic financial transactions every year. Suitable for businesses of all industries and sizes, this effective payment method is becoming increasingly popular because it benefits both businesses and customers. If you’re not familiar with ACH processing and its benefits, we can explain everything:

How to Price Your Product: The Most Common Strategies

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] How do you set the price of a product? If you’re a business owner and…

Finding the Right Clover POS System for Your Business

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

What is POS Marketing?

Although it’s the last part of the customer experience and usually given the least amount of thought, the time waiting…

Four Tips for Safe Online Banking

It was first introduced in the early 1980s, so the idea of banking online is nothing new. In fact, it’s…

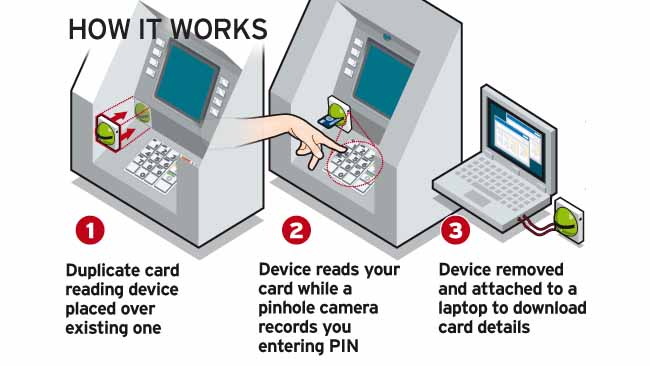

Tips to Protect Yourself from ATM Crime

Although many people install security systems in their homes or lock their doors at night, theft can still occur outside…

Four Strategies to Prevent Retail Theft

There are very few things that are as frustrating for a small business owner as theft. However. there are many…

How Business Owners Can Prevent Credit Card Fraud

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

How To Choose A Safe Pin Code

PIN is an acronym that stands for personal identification number. Put simply, this number is a security code for protecting…

Tips for Safer Online Banking

By and large, the internet has made the transfer of information much faster, and our lives much easier. Banking and transactions are no exception—over half of U.S. adults use online banking for their daily banking tasks. However, while online banking is much faster nowadays, it can be less secure than face-to-face banking if you don’t take the proper precautions.

5 Tips to Protect Your Finances While Traveling

When you’re traveling, it can be easy to get distracted with the sights and sounds around you. However, while you’re…

The VCR Program: Benefits For Merchants And Clients

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] On April 2018, VISA launched the long-anticipated VISA Claims Resolution (VCR) program. The new global…

Bitcoins: Opportunities and Risks Behind the World’s Favorite Cryptocurrency

Bitcoins are the first cryptocurrency ever created. We don’t want to overwhelm you with computer engineering terms, so to put it simply: Bitcoins are just digital money generated by high-performance computers.

Unlike dollars and euros, there is nothing for you to hold in your hands. It’s just computer code with monetary value. However, you can exchange bitcoins for cash. On May 1st, 2018, bitcoin started the day worth $9,244.32.

How Online Payment Works

Online payments are getting faster, safer, and more popular. Although you can’t see it, there’s a lot going on behind the screen. Do you know what happens in a few seconds while websites are processing payments? If you don’t, here’s how online payment works:

How To Secure Online Payments And Protect Customer Data

In the last few years, the National Security Agency (NSA), Facebook, and MyFitnessPal found themselves involved in data breach scandals. As a result, we’re living in times of increasing concern regarding privacy and misuse of personal information. While the debate is vital to avoid history repeating itself, it poses a challenge for companies that offer online payments.

Benefits of Mobile Payments For Businesses

According to BI Intelligence, the volume of mobile payment transactions is expected to double in the coming years and reach $500 billion US in 2020. If you manage a business, here’s what you need to know about this payment technology:

Top 3 Factors to Consider Before Setting A Price for Your Products

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] So, you’ve started down the path to entrepreneurship. You’ve got a great idea for a…

Why Your Small Business Needs Various Payment Options

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] With more ways than ever for your customers to pay, your small business can benefit…

Preventing Chargeback Fraud

What can businesses do to prevent chargeback fraud? Chargeback fraud is happening more and more often, and while there is…

The Risks of Chargeback Fraud

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Why Your Online Store Needs To Handle Return Policies Efficiently

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Travel-Related Business and Merchant Accounts

When it comes to all types of companies, their business merchant services help them process payments, obtain merchant cash advances, and protect their financial interests. However, some business types often do not get the same rates and advantages as others, based strictly on their industry. Specifically, travel-related businesses, such as travel agents, cruise ships, time shares, and tour agents often struggle to get a merchant bank account, and even if they do, the rates and terms are rather severe.

Is Your Business Ready For Holiday Shopping Season

The holiday shopping season has begun, and every retail business is gearing up for a busy fourth quarter. However, looking back to the last holiday season, we learned quite a bit about the increasing challenges that businesses of all sizes face in the changing commerce climate. More people are turning to the convenience and selection of e-commerce, which is causing even major, historic brands to downsize and reevaluate their operations. Other brands are still reeling from numerous hacking and data breaches, which reduces consumer confidence and costs our economy dearly.

Singles Day and Holiday Readiness (updated)

Last year, as we turned the corner on Halloween, we noted the growing popularity of “Singles Day,” that online shopping extravaganza that has become a bellwether for economic trends heading into end-of-year holidays.

By way of background, CNBC recounts that “Singles’ Day was first celebrated in the 1990s by young, single Chinese as an anti-Valentine’s Day.” (Consider the array of “ones” on 11/11, by way of symbolism).

The Equifax Breach and Your Business

As one of the three major credit monitoring and reporting entities, this organization is tasked with tracking and rating the financial history of consumers. Their reports contribute to crucial financial decisions. For example, if you want to purchase a home or a car, your lender will pull your credit report from one of the three institutions, including Equifax.

Even the interest rate your bank gives you on your credit card is based off of their reporting.

Now That Future’s Passed: A Look Back at 2017 (updated)

“It’s going to get worse before it gets better,” we wrote as 2016 became 2017, citing a Guardian article that had proclaimed our previous year as “The Year of the Hack,” and what it meant for the year ahead, and the years after that — like, for instance, that former “future” we’re living in now.

Breach Days: Equifax and Beyond (updated)

When this post first appeared last summer, we called it “The Breach Days of August,” sounding various alarums from what had been the just concluded Black Hat conference in Las Vegas (a gathering of mostly “white hat” hackers). In what surely now must strike us a more innocent times, we mentioned

that CNN Money was reporting that EMV chip cards — the very things allegedly keeping us safer at point of purchase could perhaps be rewritten to “appear like a chipless card again. This allows them to keep counterfeiting — just like they did before the nationwide switch to chip cards.”

Things to Know About Protecting Your Merchant Account

As a business owner, you know that your merchant bank account is crucial for your payment processing and financial solvency. This powerful tool helps transactions proceed quickly and safely, and can also be an asset for funding and cash flow. However, chargebacks can threaten your account, and may even get your business blackballed by the major banks and business merchant services. This month, we are going to take a deeper look at chargebacks, how to prevent them, and why high-risk merchants such as debt collection agencies are particularly vulnerable to them.

September of Our Year: EMVs Delayed, Storms Felt (updated)

In last fall’s Labor Day survey, we wrote that the unspoken rule was to put white clothing away until Memorial Day rolled around again, but that would seem to apply mostly to cool-weather climates, of which there are fewer and fewer, at least in the American west, where AVPS is headquartered.

Data Breaches Hit “All Time High” — Can We Keep Them From Getting Worse? (Updated)

All Time High was a good name for a James Bond film theme. But it’s an unwelcome descriptor for a trend in data breaches and hacks. As we wrote earlier this year, Insurance Business Magazine reported, “there were 1,093 tracked data breaches in 2016, a new all-time high according to a report from the Identity Theft Resource Center (ITRC) and CyberScout…the previous record was 780, recorded in 2015, making a 40 per cent increase last year. However, the report asks whether it is the number of incidents that has risen or just the reporting of them by states.”

How Mobile Payment Processing Is Growing

Mobile processing is a permanent part of the business landscape, and it is one that continues to grow in importance. Whenever a company decides to reconsider its business strategy to keep up with current demands, the payment system it uses should be a large part of that discussion. Mobile payments are a major component of many companies’ monetary collection systems, making this form of processing all the more important for businesses that want to have a competitive edge in today’s market.

PCI Oh My: New Study Shows Compliance Can “Make or Break” Merchant Relationships (updated)

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Travel Tips & Tricks for Summer Card Carriers

Summer travel always brings with it a shifting list of do’s and don’ts, in terms of what to pack, where to go, what to expect if you’re queueing up for a TSA line, etc. It’s also been a good way to mark how people are feeling about the economy around them: Do they see themselves as having the extra income and time for a trip?

Importance Of Mobile Credit Card Processing

In the past few years, mobile processing has revolutionized the way in which many business models operate, as well as create an avenue for start-ups to get their proverbial feet wet. For example, we all know that most new businesses fail within the first two years. Rather than invest in a physical location, massive inventory, or huge upfront costs, budding entrepreneurs can experiment on a small scale to demonstrate proof of concept.

How To Prevent Financial Risks When Traveling Or Shopping

We are deep in the heart of the summer travel and shopping seasons, which means more of us are getting out, getting on the road, and exploring new places. Tourism and travel help boost our economy, and promote prosperity among many communities across the nation. However, this time of year also creates serious dangers when it comes to the safety and security of your financial information. The last thing you need is to go out of town, only to get stranded because some enterprising thief or hacker managed to steal your credit or banking information.

If It’s Wednesday, It Must Be SID4B Training Day! (WebEX Link Inside!)

We’re excited here at AVP Solutions, as Wednesday, April 19th rolls around!

Not because it’s the day after Tax Day (well, maybe a little because of that), but because it’s our long-talked about SID4B Training Day, at last!

Our mission at AVP Solutions has always been to equip our merchants with the most comprehensive services and the highest level of customer service available, and as you know, we’ve been rolling out SmartIDentity for Business (SID4B) to our core suite of services!

May the Force Not Be With You: Guard Against Fraudulent Force-Posted Transactions (Pt. 1)

Among the many types of hacks and frauds we warn about, or sadly have to post about (a report discussed by Reuters this week finds that “cyber security breaches erode companies’ share prices permanently”), one to be especially vigilant about is the “force sale” (sometimes called a “force capture” or “offline transaction.”)

How To Overcome First Challenging Year Of Your Business

That’s why you need a carefully constructed plan that addresses your infrastructure, funding, staffing, payment processing, and goals for growth. This plan will serve as your proverbial roadmap, and will help you better anticipate any challenges and prepare for them.

AVP Solutions Launches “SID” (SmartIDentity for Business) Training; Join us on April 19th

Our mission at AVP Solutions is to equip our merchants with the most comprehensive services and the highest level of customer service available. In that tradition, we are proud to announce the addition of SmartIDentity for Business (SID4B) to our core suite of services!

How Portable Preparing Empowers Imaginative Business

For years, places like farmers markets, food trucks, sports concessions and a slew of others all operated on a cash-only basis, which in turn, limited their customer base. Those days are fading fast. Now mobile phone credit card readers ensure that customers can pay any way and at any time.

Better Credit Card Deals Can Be Yours For the Asking

Who knew that a better deal on credit card rates and fees was simply yours for the asking? Well, evidently everyone who picked up a telephone and dialed up and asked for it! And by “telephone” and “dialing,” we actually mean tapping the number pad on that little computer in your pocket.

Significance Of An Expert Planned Online business Site

Why Hiring a Professional Website Designer is Good for Business Small businesses reach new audiences through e-commerce, which allows them…

Credit Card Processing Risk Management Solutions

With summer only a couple of months away, now is a good time for seasonal or tourism-oriented businesses to give additional thought to secure payment processing. This hectic season brings an opportunity for profit and brand-building, but it also entices word-be thieves to take advantage of the growing crowds.What makes seasonal businesses so attractive when it comes to card skimming, cloning, and the use of counterfeit credit and debit cards?

Record “Green” Predicted for St. Paddy’s; Eyeing Payments on Other Side of Rainbow

As the above-linked summary states, “spending for St. Patrick’s Day is expected to reach $5.3 billion, an all-time high in the survey’s 13-year history. The total is up dramatically from last year’s $4.4 billion and tops the previous record of $4.8 billion set in 2014.”

The Two Types of Credit Card Users: Churners and Chuggers

There are numerous pieces of philosophical shorthand floating around about there being “two types of people” in the world — those that like a certain type of entertainment or music, say, or those that don’t. Perhaps a kind of food, or a political philosophy.

Beyond the Antivirus Software, Pt. II

As we write this morning, the internet is recovering from a partial loss of “the cloud” as Amazon’s S3 server had gone out, resulting in the shuttering of numerous websites and services. Since we posted last week, a massive potential breach to numerous websites has made headlines, as the Cloudflare security service used by many sites– like Uber and OKCupid — was itself compromised for several months.

Are You Using The Best Card Processing Solutions?

At AVPS, we believe that continued discernment is what sets great entrepreneurs apart from the rest. As we approach tax time, now is the perfect time to take a second look at your options to see if you can get better rates, better service, or simply the peace of mind that you are getting the best provider for your financial needs.

You May Need More Help Than Your Antivirus Software Can Give

A recent article in Slate’s “Future Tense” section has some sobering news: “In 2005, Panda Software reported that a new strain of malware was discovered every 12 minutes. In 2016, the cybersecurity company McAfee says it found four every second.”

Benefits Of Mobile Processing For Small Business

In the past, the AVPS team has talked about how mobile credit card processing has revolutionized innovative small business models. From food trucks to seasonal businesses, mobile processing removes the typical restrictions that keep entrepreneurs chained to traditional brick and mortar storefronts.

A Brief History of the Unlikely Rise of the Credit Card

We don’t know if you’re in the habit of reading the venerable Christian Science Monitor, but they’re a reliable source of what remains real news, and many of their features and backgrounders are fascinating, as well.

Things To Know About Merchant Cash Advances

Likewise, when some businesses do face challenges, such as facility improvements, inventory shortages, or simple slow-downs, they don’t know where to turn. They could seek out traditional loans, but feel uncertain that they can meet the terms and the timelines required.

New Fintech Rules? The Yin and the Yang

Along with all the turmoil occupying our headlines these days, comes some under-the-radar discussion of potential new rules that could affect the financial sector — or at least the financial technology or “FinTech” sector.

of SID, the Fed, and EMVs

In payments news, we see that the Fed has issued a progress report on its previously announced “Strategies for Improving the US Payment System”, a plan that included “several strategies to enhance the US payment system to ‘meet the changing demands of American consumers and businesses,’” as synopsized by the Banking Technology website.

Fraud Prevention. Why This Issue Affects All of Us

The issue of secure payment processing is obviously a longstanding battle between banking institutions and thieves, but this is a problem that affects both business owners and customers as well. We often think of the effects of fraud on a singular level—how it affects us. However, with thieves and hackers always on the cutting edge of innovation, we all must band together to combat this pressing problem

Hacks Happening! But AVPS and SID Can Help!

We knew we’d have some “breachy” news to report this month — we always do — but little did we know how much! For starters, just up the boulevard from AVPS, L.A. Valley College decided to pay out $28,000 in BitCoin for a New Year’s Eve attack where ransomware captured their computers, or more specifically, the files on them.

How Mobile Credit Card Processing Can Boost Efficiency

If you’ve been reading the AVPS blog for the past few months, you know that we’re firm believers that mobile processing can boost efficiency. However, we also know how many small business owners feel about change or incurring a new cost. With the busy holiday season behind us, now is the perfect time to take stock and give your operational performance a check-up.

Breaches Predicted; Help is Coming

The CIO website is rife with predictions on coming cyber threats and data breaches for the coming year, laid out across several different articles. In one on Five Data Breach Predictions for 2017, they list, among the quintet of threats, a “focus on payment-based attacks despite the EMV shift taking place over a year ago.”

Happy New Year! And In A Time of Breaches, “SID” Is Coming!

Of course, just because the calendar changes, that doesn’t mean the issues, ideas, and economic trends of the previous year suddenly “go away” either. Foremost among those, and something we report on often in this space, are breaches, “hacks,” and the latest frontier of data security — an area that seems like it will only get more “parlous” for those trying to safeguard sensitive,personal data, whether their own, their customers’, or both.

Discover Wireless Payment Solutions

If you are planning a significant remodeling project for your business, you probably face a common dilemma: Should you close for the duration, or should you attempt to remain open during construction? While remaining open is ideal for keeping financial continuity, it also creates its own set of challenges. You need to maintain a safe, functional environment for your customers while also adjusting to an operation that will feel like it’s in constant upheaval.

The Christmas Economy’s Home Stretch — and One More Big Hack

Normally we like the holiday weeks to have more “genteel” posts, with a little holiday history, and some prognostications for the current economy and the new year.

Well, okay, sometimes those prognostications aren’t necessarily “genteel,” given that the future can be a murky place, but all in all, we like to infuse some sense of “seasonal lights” into our updates.

Feds Raise Rates — Will Consumers Move to Debit?

In the world of revolving credit and saying ‘charge it,” the big news this week is that the Federal Reserve…

Small Scale Start-Ups Mobile Credit Card Processing

For many people, this time of year brings out that inner-yearning they have for taking their entrepreneurial ideas to the next level. They want to start a business but are hesitant to jump into a significant investment when they have so little experience. However, at AVPS, we believe that the best businesses come from passionate people who scaled their operations smartly. In our incredibly unique economy, they have the ability to explore unusual business models that allow them to give their ideas a proverbial test drive without

overextending themselves financially.

Holiday Card Safety While EMV Gets Pushed 3 Xmases Ahead

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Credit Card Processing Risk Management Solutions

As we head into the throes of the holiday season, you are preparing your business for the current influx of customers. You’re focused on inventory, logistics, customer service and maybe even extending your business hours to accommodate the growing crowds. However, for thieves and hackers around the country, this season also represents one of the easiest times to take advantage of your distracted state. Where you see

profit potential, they see the perfect opportunity to take money away from you and your customers and put it in their own pockets.

Post-Monday Postmortem: More Now Shopping Online

And… we’re back! Still in mid-holiday season, and yet perched between Thanksgiving and that last round of Christmas/Hanukkah/New Year celebrating.

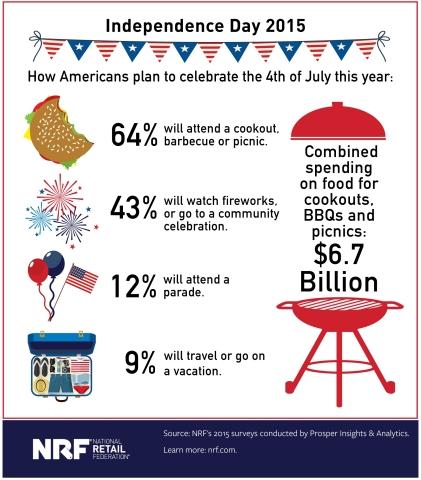

We hope your Thanksgiving was nourishing on many levels. As for what we cover here, it seems to have been productive for businesses, too. According to CBS, “early indications are that this should be a good shopping season, with nearly 154 million people on the prowl for holiday deals during the Thanksgiving weekend, up 2 percent from last year, a National Retail Federation survey indicated

Giving Thanks, Eating Pie, Logging On: Thanksgiving 2016

Historians, according to a round-up of Thanksgiving facts from the U.S. Census Bureau, recorded other “ceremonies of thanks” given by various groups of European settlers in North America — not just pilgrims. Indeed, most of these were probably Biblically-derived, and “included the British colonists in Virginia as early as 1619.”

Why Small Businesses Need A Web Presence

With so many small businesses struggling to remain viable in our economy, they often need to employ innovative strategies to reach both existing and new customers. Even the smallest of businesses needs a website as a way to connect, because that is how we research, learn, and ultimately decide where to spend our money. If your small business is feeling the struggle of competing with larger organizations, you should consider creating a new website, or revamping your existing site.

Post-Election, Will Shoppers Be Ready to Kick Off Holiday Buying?

We write this on our propitious Election Day 2016. And while this isn’t a political blog, as such, it’s no secret that happens in the worlds of government and politics has a direct effect on economies — and thus, on your customers and what they buy.

How To Find Best Merchant Account For A New Business

Starting a new business is always a stressful endeavor. As entrepreneurs try to transform their passions into success, they often realize that life as a business owner is not at all what they expected. They focus so much on bringing their products or services to the public that they fail to understand the finer logistics that are required to thrive. From setting up a merchant account for a new business to training employees, they deal with a wide variety of issues that are sometimes completely outside of their skill-sets.

Study: Debit Cards Keep Outpacing Their Credit Counterparts

“The amount of debit cards is growing at a faster rate than that of credit cards, according to RBR’s Global Payment Cards Data and Forecasts to 2021 study,” as Business Insider reports.

Protect Your Customers During the Busy Season By Focusing on Secure Transactions

During this high-traffic season, businesses across the country will be more vulnerable than ever to hackers seeking to steal their customers’ financial information. Because of this, businesses need to take special care to ensure that they are providing the most secure payment processing possible. At AVPS, we believe that businesses need to make this a top priority, not only for their customers’ safety but for the sake of their own reputation

The “October Country” is also “The EMV Country”

…or at least, it’s “EMV Anniversary” time. Last year, in October, it was the “liability” swtich that mandated merchants switch to EMV-capable POS devices, or be left to reimburse any card fraud expenses themselves.

Impress Your Customers With Innovative Payment Logistics

With the holiday season fast approaching, retailers across the nation are gearing up for their busiest season of the year. For newer businesses, the physical logistics of a sudden influx of customers often presents one of the greatest challenges in defining their brands. Come the first week of December, while you’ll

want to see customers coming through your doors, will you really want to see a long line of impatient people rapidly becoming unsatisfied with their shopping experience?

Holiday Economy So Far in “Treat” Mode; Plus: Credit Cards Like Candy Corn?

Our holiday posts give us map markers to see how the economy is faring, and if Halloween “spend trends” are to be believed, your customers seem to be in a pretty good overall mood right now.

“Americans take Halloween pretty seriously, and this year appears to promise some wicked spending,” according to the Ameritrade website. “More than 171 million people could celebrate the fall holiday, spending an average of $82.93, up from last year’s $74.34, according to a survey by the National Retail Federation (NRF). Total spending on Halloween could reach $8.4 billion, an all-time high and up 20% from a year ago, the NRF said.”

Feds Facing Forward, Fighting Fraud

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Online Payment Processing Solutions

Online sites like Etsy offer entrepreneurs the ability to create virtual storefronts with ease, but their services often come with a higher price tag than many expect. They make their money through fees, but those fees come at nearly every level of the process. For example, Etsy charges a fee to list an item, then once purchased, they charge both a transaction fee and a payment processing fee.

First Monday In October — Credit Fees Get Their Day in Court

The First Monday in October is, famously, the start of business for each Supreme Court session. This particular court, of course, remains in a 4-4 ideological tie until the Senate decides it might be time to go to work and confirm a judge for the current vacancy.

How Fraud Affects Your Customers and Why You Need EMV Processing

Chip cards, as consumers typically refer to them, are now the standard for secure payments. They help reduce fraud, and give your customers an added layer of protection. We know that upgrading your equipment to offer this increased level of credit card transaction security can be frustrating, but let’s take a look at what happens to a customer when he or she is the victim of card fraud.

Payment Cards Set to Surpass Cash For First Time Ever

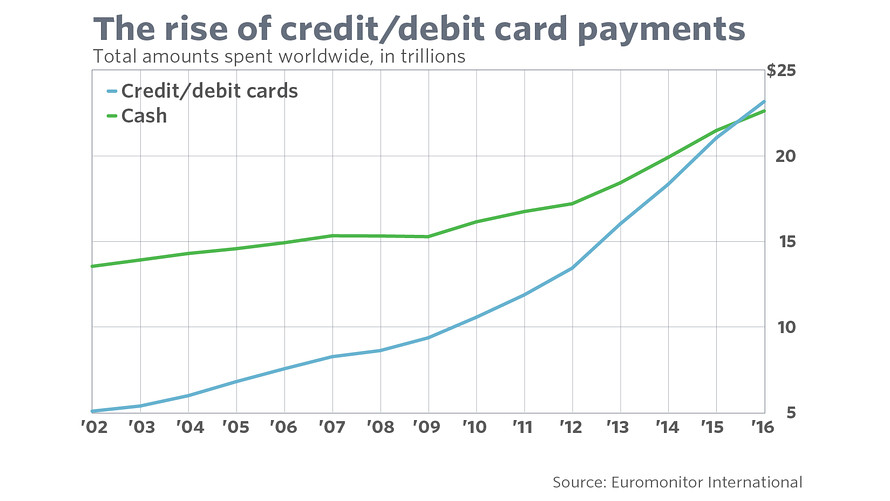

“Is this the beginning of the end for cash?,” a recent article in Marketwatch asks. No, we’re not talking about governments yanking currency and forcing everyone into an electronic payment system. Rather, we’re talking about a shift in the use of payment cards that “has happened gradually over the last 20 years, ‘dramatically skewing in favor of card and electronic payments,’” according to the same article.

Small Businesses And Holiday Logistics Planning

With fall’s arrival, now is the perfect time to look ahead toward the upcoming holiday season and plan your sales strategies.

While larger corporations have extensive logistics procedures to handle increased holiday traffic, smaller businesses often struggle to adapt their operations effectively. As a small business owner, you know that one of the worst things you can do is create an environment that frustrates potential customers; long waits and lines for payment can cost you in both sales and reputation. While adding additional payment terminals seems like the logical solution, you also know that this is a lot of expense and equipment that you just don’t need for the rest of the year.

AVPS has the perfect solution through our mobile credit card processing options.

One of the reasons we love mobile processing technology is that it lets businesses adapt to their changing needs without having to completely rework everything. Imagine your current location, and the ability to check out customers quickly and easily beyond your existing register set-up. Your employees can accept payments instantly from around your location, which can help you better manage customer traffic, expedite transactions, and increase sales volume. When you are able to maintain a steady flow of transactions, you not only help boost your sales, but you also create customer goodwill which leads to positive reviews and repeat customers.

While it still may seem early to focus on holiday season sales strategies, remember that your small business does not have those professional efficiency experts like the big-box stores. It’s up to you to take an honest assessment of how you can improve your operations, especially when your customer volume increases dramatically.

AVPS wants to help, and with mobile phone credit card readers, we can transform this holiday season into your best one yet.

Save

Save

Two Things Growing: Smart Card Use, and Retailer Resistance

Fall is usually viewed as harvest season, where the crops grown over summer are brought in and stored for winter. Some things still grow in the fall, though: artichokes, for example. Cranberries and pumpkins. In the payment news cycle this week, comes word of some additional growth: Namely that of “smart cards.”

Pushmi-pullyu: Payments on the Coming “Internet of Things”

The “Pushmi-pullyu” is, of course, a llama-like character from the Dr. Doolittle books and films — one with heads on either end of its body. But the legendary beast may also be a symbol of how the idea of “payments” are still sorting themselves out on the coming “internet of things.” At least, according to MasterCard CEO Ajay Banga. In comments to the Diginomica website, he said there would be “a lot of “interesting pushing and pulling over time,” as the idea of “payments” — and commerce — sorted themselves out over this expanding new network of wired-up, well, “things.”

How AVPS Can Help You Take Your Business Concept To Success

Many entrepreneurs are thinking outside of the proverbial box when it comes to launching new businesses. They see just how the cards are stacked against them, and they don’t want to invest all of their capital without a definitive proof of concept. After the recent recession, entrepreneurs are even more hesitant to launch full-scale operations in such an uncertain economy. While this creates many challenges, it has also created an

environment of possibility From pop-up storefronts to mobile trucks, new businesses are redefining the concept of a start-up, and enriching our communities through their efforts.

Why Your Business Needs Online Shopping

We all want to support local businesses, but we also have become attached to the convenience of online shopping. This utility goes far beyond cost savings and ease—it’s allowing people to find unique products, too. Additionally, people who find it difficult to navigate in-store shopping, like the elderly, parents of small children, or those with limited mobility, find that online options offer the best way to get the things they need. While the growth of online shopping offers incredible opportunities, it’s also hurting many small businesses that provide valuable contributions to their local communities. They simply can’t compete with businesses capitalizing on our affection for the comfort and convenience of online shopping.

Study: Fraud Up Over 100% Since Last Labor Day

According to the latest AAA survey, “cheap gas prices are expected to boost Labor Day weekend travel as revelers pursue a last blast of summer fun before autumn weather begins. About 55 percent of Americans say they’re more likely to take a road trip this year due to lower gas prices.”

Affordable Card Processing Solutions

Is your small business struggling under the weight of operating costs? Even those owners with a history of business experience and acumen can find that the tools they need eat too much into their profit margins. Payment processing, for example, seems like a system of fees you grudgingly must pay in order to provide your customers the convenience of debit and credit payments. In the modern market, you can’t forgo digital payment processing, either, but you can ensure that your retail merchant account is providing you the best and most affordable card processing solutions. Our AVPS team will help you determine if you can reduce those operating costs by giving your current payment processing a serious check-up. By taking a second look, you may find out that you are eligible for better rates.

Millennials and Credit Cards: Yes or No? Or both?

A recent New York Times piece has made some financial news, declaring that “data from the Federal Reserve indicates that the percentage of Americans under 35 who hold credit card debt has fallen to its lowest level since 1989, when the Fed began collecting data in a standardized way.”

Increasingly Cashless in an Age of “Big Hacks”

We never want our posts to be about hacks or data breaches two or more weeks running. But as most of us find out, when checking the climate-shifted weather reports, or reading up on the elections, the news cycle doesn’t bow to our own particular needs or desires.

Stealing Payment Card Data “Dead Easy;” “Quickchip” Comes to NorCal

It’s a yin/yang, up-and-down week in payment and security news. Though to be sure, the downside hasn’t been “overly” down, in terms of major breaches or security hacks (though if you have a Yahoo account, you may want to consider changing the password — again).

Is Your ECommerce Business Underperforming? Common Missteps You May Be Making

If your ecommerce business just isn’t performing to the level that you want, it may be time to reassess your approach. As your trusted provider of retail merchant accounts, AVPS wants to see all of our ecommerce clients achieve their goals and continue to grow.

1 in 3 Hit By Hacks; U.S. Near Top Due to Slow EMV Adoption

A recent study by ACI Worldwide and the Aite Group has found that upwards of 30% of global consumers have been victims of some type card fraud in the past five years. Statistically then, this has happened to almost a third of the people reading this very article.

Merchant Cash Advances At A Glance

We are now halfway through the calendar year—and at the start of the fiscal year—which means many businesses are taking stock of their performance, and deciding how to best position themselves to come out of 2016 feeling successful and fiscally confident. For some, however, they are realizing they may need an injection of capital to stay on track. Perhaps they need immediate inventory, or now is the time for much-needed expansion or repairs

PCI Develops Payment Security Resources For Small Businesses

As their recent press announcement puts it: “small businesses around the world are increasingly at risk for payment data theft. Nearly half of cyber attacks worldwide in 2015 were against small businesses with less than 250 workers, according to cybersecurity firm Symantec.”

And now, to try and help these smaller companies shore up their defenses, the PCI Security Standards Council (PCI SSC), whose security protocols and recommendations we report on here, on a recurring basis, have now set up a Small Merchant Task force which has developed a set of payment protection resources for those same businesses.

Be Our Guests: POS Security Tips from the Hotel Biz

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text”] In a little bit of irony, a few days after the Hospitality Technology website ran…

Consumers Suing Lax Retailers, post-EMV. Plus: Baseball

In another sign of how the responsibility for data security — and the liability for same — is shifting, Payments Source reports that “merchants are facing consumer lawsuits stemming from the introduction of EMV-chip card security at the point of sale in the U.S., exposing the issues many stores must contend with now that they are held liable for fraud and chargebacks.”

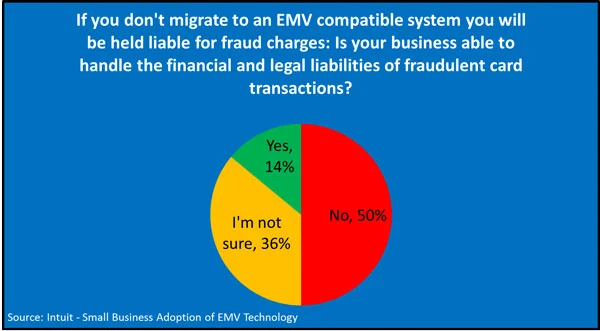

Ongoing EMV Processing Transition. Is Your Business Letting Misinformation Cloud Your Decision-Making?

In a recent blog, we asked an AVPS colleague to report on how a variety of businesses in her area were adapting to the required transition toward EMV chip card processing. As we’ve reported extensively, EMV chip cards are now considered the accepted standard for secure payment processing. While her experiences highlighted the rocky transition that even national retailers face during this migration, it also highlighted how even the smallest local businesses have easily converted to EMV.

Brexit Signs: How the Vote Might Affect Payment Cards

True, Britain has always kept its Pound, as far as currency, so has no “Euro” to give up. But as a country that was part of the “E” of those “EMV” standards we keep writing about (“Europay Mastercard Visa”), what, if anything, happens now to international payment protocols with Britain’s seeming withdrawal?

6 Tips For Creating A Successful E-Commerce

E-commerce allows people to turn their passions into thriving businesses, giving them a way to connect with customers from around the world. E-commerce also allows entrepreneurs to scale their businesses as needed, because they don’t have to invest in a brick-and-mortar storefront and the logistics that come with it.

Preparing Seasonal Business Merchant Accounts Processing

Small, seasonal businesses enrich our communities and provide valuable contributions to local economies. However, this unique business model can be tricky to execute successfully, as budding entrepreneurs do not realize that they require the same planning and resources as traditional businesses. Whether you want to run a snack stand at a water park, or design Christmas light displays, you need to approach your new business with the same consideration and commitment as a brick-and-mortar operation

Scam Alert, Pt. II: How to Protect Against Skimmers

Last week, we mentioned a rash of phony invoices that are being sent by companies alleging to help with EMV upgrades, along with some preliminary advice on how to be aware of whether skimmers were being placed on the POS devices at your business.

Scam Alert Warning, Pt. I: Phony EMV “Invoices” and All-Too-Real Skimmers

Unfortunately, both this week and next, we have a couple of scams affecting merchants to warn you about, either trying to pry money out of merchants directly, through phony invoices, or to get that money from your customers by “skimming” their credit card information.

Let AVPS Help Your Payment Processing Grow With You

However, how do you know what equipment you need, or how it will integrate into your day-to-day operations? Whether you need on-site solutions, mobile processing utilities, or payment options for your website, Advanced Payment Solutions is here to help you make the most of your retail merchant account. Our team can help you select the services and equipment you need, and provide the training so that you feel confident in your payment processing.

Credit Card Security and Your Vacation

Summer is the busiest travel season, but it’s also a time when credit card transaction security risk is on the rise.

If you’re planning your seasonal vacation, you need to take some basic precautions to ensure that your experience isn’t marred by financial disasters. Here are some tips for keeping your credit cards safe:

PCI Sets New Security Standards – Gets Surprising Pushback

As the Finextra website reminds us, “merchants and other businesses globally use ‘PA-DSS Validated’ software to ensure they can safely accept payments, both in-store and online.” And now there are updated “procedures for secure installation of software patches and updates, and instructions for protecting cardholder data if using debugging logs for troubleshooting, as these can be exploited during a compromise.

EMV’s Slow Rollout — Viewed from the Hudson River Valley

Last spring, around this travel-y time of year, we had just gotten back from Europe, and reported from the land of EMV use (that’s where the “E” in those initials comes from!) about how customers were adapting to inserting their cards, and perhaps signing or using PINs more often.

Payment Solutions for Sole Proprietors—AVPS Can Help Grow Your Business

Sole proprietor businesses help drive our economy, and make up an incredibly diverse pool of talents across all industries. From personal trainers to writers, housekeepers to consultants, independent entrepreneurs bring a wealth of talent and skill to our lives. If you are a sole proprietor, you understand the difficulties you face while being the driving force behind your business. You are the sales, service, marketing, and accounting department wrapped up in one very busy package. At Advanced Payment Solutions, we understand, which is why we can set you up with a retail merchant account and the ability to accept credit cards. Our merchant account solutions help businesses of any size craft the most safe, secure payment processes, while also providing the support they need for success.

Economic Green Lights, as Summer Travel Plans a “Go!”

Memorial Day is here, and it’s once again time for our annual(ish) look on what the unofficial kickoff to summer means in terms of economic trends, etc. And if you’re about to head out the door, to either hit the road, the beach, or an unacceptably long TSA line, we’ll give you the short answer to scan on your phone:

Summer Security Check-Up—How to Avoid Common Pitfalls During Busy Seasons

With summer just around the corner, it’s time for all businesses to have a security check-up when it comes to…

Senator Sets Sights on Slow EMV Rollout

We’ve reported here not only on the coming of EMV standards to American debit and credit cards — those “extra” chips that create unique codes for each sale, and make financial information in “payer present” transactions — i.e., at stores like such previous hack targets as, well, Target, Home Depot, etc.

A Snapshot of EMV Compliance in Action—Cautionary Tales of Disparity and Misinformation

We all know that EMV chip cards are now the gold standard for secure payment processing, and Advanced Payment Solutions has long been educating our clients on why this transition is so important for their businesses. If you’re still confused about EMV cards, you’re not alone. Likewise, your employees may be even more misinformed about how these new rules for credit card transaction security affect your business. We believe many owners are struggling to get on board and comply with EMV.

Payment Processing Fees—How Do They Fit Into Your New Business Model?

As a new business owner, you know that the logistics of getting your business up and running raise many questions. Likewise, you’re learning about merchant card processors, and how the costs of accepting credit cards factors into your overall financial planning. Even the smallest, most mobile business benefits from the ability to accept credit and debit cards, but those new to the concept often balk at how those transaction fees cut into their bottom lines. Let’s take a look at two different models of addressing this issue and examine the pros and cons:

NerdWallet and NASDAQ on the Wise Use of Credit Cards

We often hear that too much use of credit cards — as opposed to debit card use — is a sign of household budgetary woes, and eventual drowning under unmanageable interest. And when credit cards are used simply to “borrow money,” during times of economic distress, this may well be right. But this week comes two different articles, one on the Nerdwallet website, the other on NASDAQ’s, espousing both the frequent and judicious use of credit cards. Not to pile up debt, but rather, to reap the rewards and actually manage household “money” better.

Email Breaches, the Connection to Same-Day ACH and a little “PCI”

Unfortunately, we have more “breaching” to report this week: As Reuters reports, “hundreds of millions of hacked user names and passwords for email accounts and other websites are being traded in Russia’s criminal underworld.”

Here Are EMV Quick Chips

There have been various impediments to the adoption of an EMV standard here in America — that extra chip on a credit or debit card that assigns every transaction a unique code, preventing the re-use of information, while at the same time requiring a signature or PIN number for validation.

Capturing the Magic—Unconventional Business Models Reinvent the Marketplace

As you’ve seen from recent blog posts, AVP Solutions understands that younger entrepreneurs are reinventing conventional business models, and we…

Understanding Merchant Account Cash Advances—Is One Right for Your Business?

Recently, we discussed some basic points that every potential new business owner needs to consider during their brainstorming and planning processes. One of those key tips was to learn how their merchant accounts factor into their operations. As you know, your merchant account is what gives your business the ability to accept and processes payments, like checks and credit cards.

Report: ATM “Skimming” Up over 500% (!)

In another sobering reminder that the conveniences of electronic banking and payments bring their own unique risks, a report is out from the FICO folks — yes, those same people who so imperfectly provide credit scores — saying there’s been “a sixfold increase in the number of ATM machines in the United States compromised by criminals in 2015, compared with 2014,” as the NY Times sums up.

Food for Thought—Common sense Tips For Those Dreaming of Starting a Business

We’ve all heard the statistics—most business start-ups will fail within the first year. Even the best ideas or products can…

The SF Fed on Fintech: Payments, Banking, to Keep Evolving

“While fintech can also improve not just the accessibility but the quality of service—something that consumers are demanding—we also need to look out for the resilience of the financial system as a whole.” The words are those of John C. Williams, President and CEO of the Financial Reserve Bank of

San Francisco. And not doubt the very contradictions of the quasi-public functions of the Federal Reserve can be summed by the fact that the head of each branch is both a President…and a CEO.

Pop-Up Businesses—A Unique Concept That Helps Both Entrepreneurs and Their Communities

In our post-recession economy, the pop-up business model is taking millennials by storm. Sometimes referred to as a “finite business,” pop-up businesses capitalize on buzz and transform entrepreneurial creativity into a unique experience for both the operator and the community. The rise of pop-ups began around 2008, when the recession created a virtual vacuum in the business world. With so many businesses going under, we experienced a rise in vacant properties with no long-term purchase and rental prospects in sight. However, the short-term pop-up business could bring interest back into a property, thus benefiting both a cash-strapped entrepreneur and a struggling property manager.

The Security vs. Freedom Debate: Payment Card Style!

“Those who sacrifice liberty for security deserve neither,” Ben Franklin once famously remarked. The question is whether the famously frugal Mr. Franklin would be happy knowing that most customers today, when it comes to payments, are usually choosing “freedom” over “security.”

Small World, After All: The Effects of Card Use on Global Economies

“Greater worldwide card use raises a number of questions.” We would concur, and in fact say that wanting to answer those questions for you, and your business, is what has spurred this blog (and our weekly newsletter) these past few years.

Is Your Business’s Online Presence Lackluster? Why You Need to Rethink Your Online Activity

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

“Fintech” and Futures

Last week, we touched on a word that any reader of this blog should probably add to her vocabulary at this point: “Fintech.” As we noted, it’s a contraction of “Financial Technology,” and it’s popping up everywhere — particularly in studies of how fast consumer finance, and the finance industry itself, is changing.

Spring Brings New Marketing Opportunities—Get Out in Your Community with Mobile Processing Solutions

With spring just around the corner, now is the time to think about all those inventive ways to take your business to the next level. The arrival of warmer weather also ushers in outdoor and seasonal activities, like farmers’ markets, fairs, festivals, and other events that provide the perfect backdrop for reaching new customers. These events not only provide a platform for spreading the word about your business, but they also capture customer attention in a unique way.

Ides of March: Ransomware Updates, and Welcome to “Fintech”

There’s no question we live in a time of constant change: rising seas, fraying politics, wired-up networks changing economies and business models almost as fast as they can be reported on. That last category, at least, falls under our purview here, so let us update you on what has changed — and what’s stayed the same — since our last blog post, a mere week ago.

Still Behind the Curve on EMV Chip Processing? Why Your Business Can’t Afford to Procrastinate

Though gas stations received an extension for the EMV liability shift, AVP Solutions is still seeing far too many businesses dragging their feet on upgrading their equipment to comply with secure payment processing regulations. We’ve discussed this issue many times in past EMV Chip blog posts because we truly believe this is one area in which retailers with POS terminals are opening themselves up for serious problems.

Drowning, Ransoming — and Staying Safe (Pt. II)

Last week, we mentioned the new “Drown” security leak, a flaw in grandfathered internet protocols that is leaving, according to SC Magazine, over 600 frequently used cloud servers — the very nodes and providers businesses use to conduct business on — “vulnerable to attack.”

Setting Up a Merchant Account? A Quick Fix May End Up Hurting Your Business

As you set up a new business, we know that you have a many options when selecting your merchant bank account provider. With the advent of mobile technologies, it seems the market is flooded with start-ups promising effortless business merchant services that certainly appeal to already overwhelmed entrepreneurs. After all, who wants to slog through the fine print and waste time comparing and contrasting transaction fees, fraud protections, and the complex rules that govern secure credit card processing?

Don’t Get “Drown”ed — Or Ransomed! (Pt. I)

Unfortunately, the news of breaches, security breaks, and data leakages is reaching critical mass again, and it’s time for another quick roundup.

Breaking as we go to press this week is news that websites — up to one third of those relying on the once-thought-secure “HTTPS” protocol — “have been warned they could be exposed to eavesdroppers, after researchers discovered a new way to disable their encryption protections.”

Do You Use Mobile Phone Credit Card Processing? What You Need to Know Now

In fact, even pop-up roadside stands now have the ability to accept payments. As the world moves away from cash-based transactions, mobile processing allows unique business models to gain and retain their customers by accepting credit card payments. However, with the recent changes to credit card processing rules, many of these small businesses may be at risk and not even know it.

Report from Barcelona: Cars, Clothes, and “Cards” Everywhere

[et_pb_section transparent_background=”off” allow_player_pause=”off” inner_shadow=”off” parallax=”off” parallax_method=”on” padding_mobile=”off” make_fullwidth=”off” use_custom_width=”off” width_unit=”off” custom_width_px=”1080px” custom_width_percent=”80%” make_equal=”off” use_custom_gutter=”off” fullwidth=”off” specialty=”off” admin_label=”section” disabled=”off”][et_pb_row make_fullwidth=”off” use_custom_width=”off”…

Avoiding the EMV Chip Processor Upgrade? Why You’re Gambling With Your Business’s Future

With the movement toward secure payment processing via EMV chip cards, many small businesses are still resisting the required upgrade to chip-reading POS terminals. At AVPS, we totally understand that no business wants to incur extra expenses, especially when you already have functional equipment. However, our nation is at the point when credit card transaction security is a truly hot-button topic, and with so many highly publicized data breaches, both credit card issuers and consumers are fed up. You know that, without EMV chip processing; your business will be liable for any fraudulent charges.

Invisible Hands and Lax Security: The Ongoing Push for EMV Adoption

“‘My dry cleaner isn’t worried about someone using counterfeit cards at his cash register,’ he said, noting that many businesses meanwhile discount the chances that hackers will siphon customer cards by sneaking malicious software onto point-of-sale devices — a problem that has lead to one breach after another at brand name retailers, restaurants and hotels over the past several years.”

Falling Gas Prices Mean More Money in Consumers’ Pockets—How Your Business Can Benefit

With gas prices at their lowest in a decade, many consumers are finding themselves with a much-appreciated boost in expendable income. While this translates into bad news for the oil and gas industry, retailers and other businesses are enjoying a season in which their customers have more money to spend. Those extra dollars affect businesses of all types, including restaurants, retailers, and home improvement. As a leader in merchant account solutions, AVPS wants our clients to make the most of this trend, and capitalize on a customer base with a little bit more money in their pockets. Here are some ideas for making the most of those low gas prices:

Taking Your Fledgling Business to the Next Level Starts with Your Very Own Website

Your handcrafted business is gaining traction, and you’re wondering whether it’s time to create your own website and sell your products through that platform. While online sites like Etsy provide space for budding entrepreneurs, they also have a long list of fees that eat into profits. And while the initial setup of a site does incur start-up and maintenance costs, these may pale in comparison to the fees that you are paying now.

Hearts to Be Celebrated This Weekend But Watch for the “Heartbreak of Hackery!”

If you’re not counting the Super Bowl, the upcoming Valentine’s Day weekend (which, by virtue of President’s Day making it a three day holiday!) is “the first major holiday of 2016, and retailers expect this Valentine’s Day will set a spending record,” according to one ABC report.

East Meets West in Rising Card Use, While Super Bowl Spending Rises, Too

We reported last week that Visa revenue was up in Europe, as more and more people in the EU use cards instead of cash, for their purchases. Which of those EU countries might you guess uses the most cards? Germany? Perhaps the UK, right across the channel from France?

Merchant Cash Advances Help Businesses Take the Leap Toward Growth and Expansion

The leap—that magical moment when a small business is ready to take operations to the next level. The logistics of expansion present many challenges. In fact, a popular TV show highlights small businesses gaining investments from corporate gurus, and the effects that come from sudden success. The outcomes often describe the dilemmas that come from major expansions, like crashing sites, lack of inventory, or poor planning. How do you know if you have enough inventory, capital, or adequate financial planning to support your expansion plans?

Save Space, Go Mobile & Get Paid—Are Phone Credit Card Readers Right for Your Organization?

In both our homes and our offices, lack of space often becomes an issue despite our best organizational efforts. At AVP Solutions, we know that our partners want the best in secure payment solutions, but sometimes, a conventional credit card reader just won’t work. They may not want the physical footprint of a traditional machine, or they find the technical set-up and cords to be too cumbersome for their space. We understand that not every merchant account holder is a brick-and-mortar store. In modern commerce, a variety of institutions now need the ability to accept credit cards, like medical offices, utility companies, churches, schools, and even on-the-go service providers.

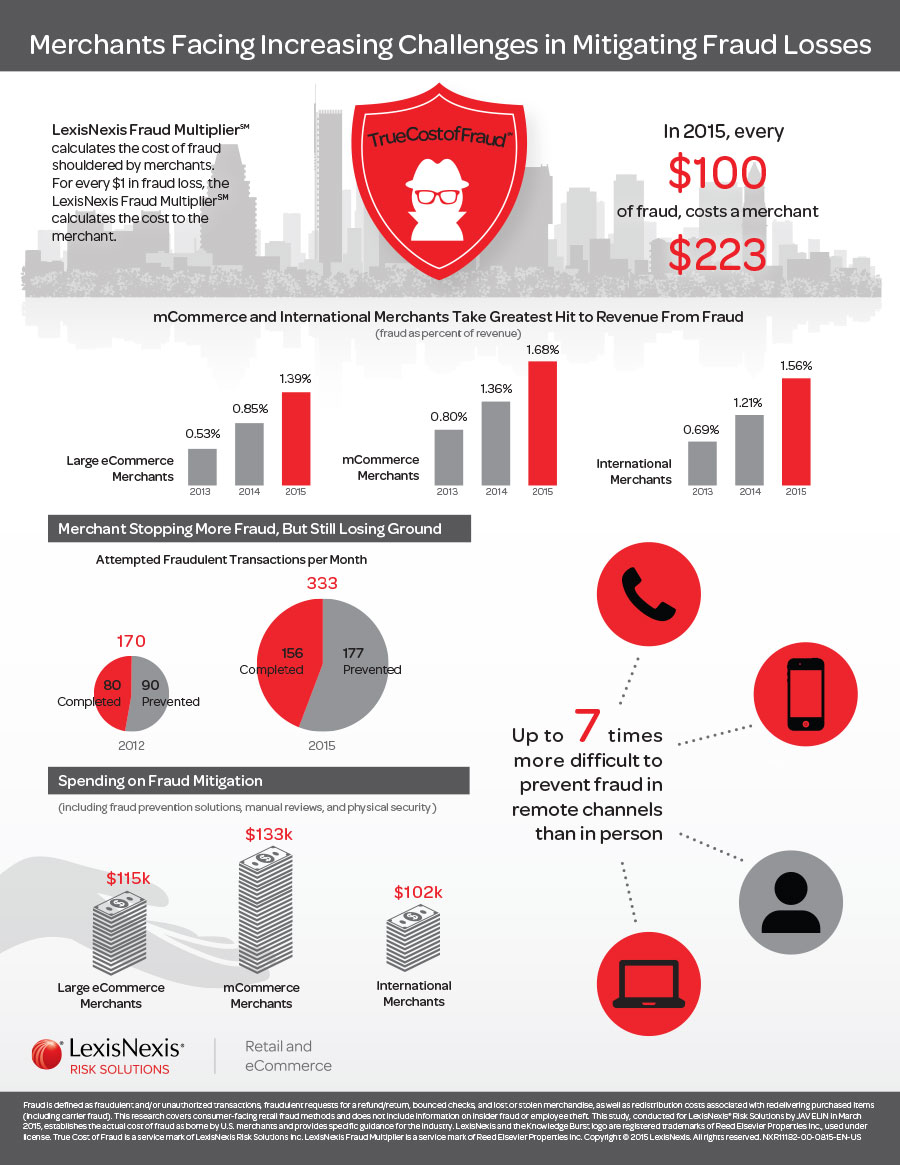

VISA Revenue Up and So Is Chip Card Use — Along With Fraud Costs

An array of studies reveal interesting new “market metrics” for the economy, at least from the payment card side of the equation.

Visa revenue in Europe is up 25% — to an all time high, as Pymnts.com reports. Visa Europe is merging with its parent company — that’d be the Visa we use for payments here in the U.S. — and reports “that it had its most successful year ever in terms of revenue growth.”

Beyond the Headlines–The Real Faces of Credit Card Fraud

We’ve heard plenty of news regarding credit card data breaches at hotels and retailers across the nation. In fact, these occurrences come so frequently that they now seem to become “white noise” in the background of our social consciousness. However, as a business owner and manager, you are responsible for making credit card transaction security a top priority for your company. Rather than focus on those attention-grabbing headlines, let’s take a closer look at the real-world scenarios that affect customers like yours every day:

Starting a New Business? Smaller, Mobile Models May Help You Get Started With Less Financial Risk

You have a great idea for a new business, but you just aren’t ready to take the plunge into a full-scale operation. After all, a new business often represents an enormous gamble for a small business owner. How do you know you’re ready? Is there an easier way to test market interest and viability without getting over your head in start-up investments? Between the internet and social media, many innovative entrepreneurs have found great success by starting out with unconventional, mobile business models. They use mobile trucks, farmer’s markets, festivals, pop-up locations, kiosks and more in order to bring their products or services to the public.

Uber Account Security Needs a Lift — and Other Trends in Payments

No sooner do we finish arranging a morning Uber ride for our son, than we sit down to sift through the week’s financial news — always redacted and highlighted here for your edification — to find that “stolen Uber accounts (are) worth more than stolen credit cards,” according to a CNBC Report.

Did Your Business Miss Out During the Holidays? Lack of E-Commerce Presence May Be What’s Holding You Back

In the post-holiday season sales analysis, one truth became glaringly evident: consumers much preferred to stay home, avoid the crowds, and shop online for those sought-after deals. Black Friday sales declined, while Cyber Monday demonstrated that the online shopping trend continues to grow. With the perceived equality in cost savings between brick-and-mortar locations versus online vendors, customers channeled their dollars toward websites.

Avoid a First-Quarter Slow Down—Why the Post-Holiday Season is Still Rich with Sales Opportunities

With the rush of the holiday season behind us, many business owners settle into the New Year with expectations of a prolonged slow-down in sales. However, now is the perfect time to reevaluate your marketing and sales strategies. Rather than assume your customers or clients struggle financially after holiday spending, think about how to utilize this time of year to your advantage.

Of EMVs and Jackpots: Your Powerball Ticket Doesn’t Need a Chip — but Your Card Does

According to Forbes, “the hype around the Powerball far exceeds any market news this week,” and who are we to argue? Up through yesterday’s drawing, even number-crunching Fivethirtyeight.com agreed, saying “everyone is freaking out about the 1.5 billion Powerball.” And, they add, “the stats agree.”

Which stats? Well, there were nearly “a billion tickets (more than three times the population of the United States)” sold overall — “a ludicrous number!”

Post-Holiday Slow Downs Give Your Business Time for Strategic 2016 Growth Planning

Now that the holiday rush has passed, your business needs to focus on how to approach the New Year with an eye toward growth and profitability. Are you missing out on some easy strategies for more frequent customer transaction completion? We often believe that the biggest challenge simply lies in getting customers in the door or to our websites. However, savvy customers now have a world of possibilities in their smartphones. They easily compare prices, research competitive products or services, and make many shopping decisions based on digital offers or information. Take the time now to re-evaluate your goals for 2016, as well as how you can make your retail merchant account better work for your business.

A New Year Resolution for More Payment Security?

We’ve been watching the MarketWatch website since the new year kicked off, mostly to track the rather breathtaking gyrations of the stock market (as well as the news out of China, the steady ebb of oil prices, and more).

New Year, New Goals? What’s Next for Your Business?

Get A Business Line Of Credit For Merchant Accounts When the holiday rush has passed, and a new year approaches,…

Long Noodles, Whole Fish, New Hacks, and Other New Year’s Business

And so we come to our last post (and newsletter !) of 2015, with 2016 just a couple of days away (or perhaps a couple hours, depending when you read this). From our end of the world’s affairs, we can report the economy has mostly held, and business has been pretty good.

Are Your Customers About to Get Scrooged? Without the Most Secure Payment Processing, They May Be

Is your business feeling the holiday pressure yet? As much as we all look forward to this joyful time of year, we also face the stress that comes with it. You focus on inventory, operations, adequate staffing, and pricing, yet you may not realize that both you and your customers face an increasing threat. This is the time of year during which fraud, hacking, and identity theft increase dramatically. Potential thieves know that, with so many customers and transactions, they face the increased likelihood of successfully defrauding both you and your customers

East vs. West: Where Did Christmas in the U.S. Start? (And Where Is It Headed?)

As with sports and hip-hop rivalries, we enter the holiday week with a good-natured “throwdown” on which coast, and its culture, gets more of the credit for creating Christmas in the U.S. as we have come to know it.

The New York Times starts out by allowing that while “New York can’t quite take credit for Christmas.. apparently, several seemingly timeless holiday traditions were invented here.”

Holiday Snapshot: Shopping Goes Cyber, EMVs Go Slower, Customers Keep Going

As we hit the midpoint between the Black-and-Cyber shopping weekend, and the big event of Christmas itself, with Hanukkah now behind us and New Year’s (and the post-holiday sales!) still ahead, a few trends seem to be, well, distinctly trending, during this time of cold snaps and hot cocoa.

Is Your Business Ready for a Busy Holiday Season?—Why Mobile Processing Can Help You Serve Customers

The holiday shopping season is officially in full swing. Early bird shoppers have clamored to check gifts off their lists while others still bide their time, hoping for the best deal. The holiday season — and the “sale season” after — will bring an increase in customer traffic to your business. However, just getting them in the door isn’t enough. You need to understand what challenges stand between your business and actually concluding customer interactions with sales. Here are some important points to remember about potential customers this season:

If Even Buskers Take Cards — Shouldn’t You?

A sweet holiday-themed news item comes our way from overseas, and not only is it too good not to share, but it may be a harbinger of things to come: Cards, and contactless and e-payments will increasingly be taken in places where no one ever expected the words “chip-and-sig” or “swipe” to be uttered.

More pie, more metrics, a little EMV, and other tasty holiday insights

It’s not just “Thanksgiving” that comes at the end of November for most Americans now, but also “Black Friday.” The latter is almost as much an alternate organizing metaphor for the long weekend’s meaning as the original day of breaking bread, pie slices, and wishbones together.

How “Black Friday” Almost Came Early — and other Thanksgiving/”Franksgiving” Tales

Happy short week! It’s become something of a tradition here on the AVPS end of things to get our blog post and newsletter out early during Thanksgiving, which of course is a week rich in traditions (including traditionally rich foods!)

Black and Cyber All Over: Holiday Shopping Is Here

Total U.S. holiday spending is expected to increase under 4% from 2014’s results, according to the National Retail Federation, but per Forrester (research group) online spending is expected to jump 11% over last year… (exceeding) $95 billion this year.”

International Blog Post Edition: Singles Day & MasterCard’s Global Liability

There’s a “quickening” at year’s end, with all the preparations, travels, gatherings, and, of course, sales and transactions that mark the season, and much of the particular corner of it that we cover here. So we have lots of “strands” to weave into an early holiday narrative for you, about immediate trends for the holiday season, and what may lay beyond it for the new year.

This is Your Holiday Season — And This Is Your Holiday Season on EMV

Now that the Trick or Treat candy is all in the “half off” bins at the store, the home stretch of the year — and the holidays — begins in earnest.

As for how the season might shape up, from a sales and business perspective, Pymnts.com is reporting that “despite some of the gloomy stats” — referring to a slowdown in consumer spending coming out of the summer, and a general flatlining of wages — “commerce watchers are predicting moderately strong growth this season. The National Retail Federation is predicting retail sales to increase 3.7 percent to a total of $630.5 billion through November and December, well above the 10-year 2.5 percent average.”

Is Your Website Up to Par? AVPS Can Help Make It Better With Payment Processing Solutions

As you grow your business, a well-crafted, highly functional website will be necessary to take your operations to the next level. In our internet and data driven world, people expect access to information and products anytime from anywhere. A missing or outdated website tells potential customers that you are behind the times or too apathetic about your own business to ensure quality products or services.

The True Cost of Fraud — And the Future Beyond Cards

We are at a kind of “nexus” in the world of payments already — between the old and the new, the secure and the not-so-secure, the wired and the wireless.

Think Beyond the Storefront—How Mobile Processing Can Expand Your Customer Base

While your brick-and-mortar business has been moderately successful, you may need to re-think how you approach expanding your customer base. Special events like farmer’s markets, fairs, community festivals, or even sports events sometimes welcome vendors across any genre. By taking your products and services out into the community, you open up your business to easy exposure and the potential for reaching an entirely new audience. However, to help support business mobilization, you also need to incorporate mobile credit card processing to capture the most new customers. AVPS can help set you up with the right tools so that anywhere you are you can make every interaction a sale.

AVPS Offers Smart Merchant Account Solutions to Help E-Commerce Businesses

With the internet flooded with e-commerce businesses, you need to focus on marketing and growing your brand in order to stand out. But are you still stuck with those necessary operations, like how to accept credit cards, establishing an e-commerce merchant account, and creating a business plan for long-term financial stability? At AVP Solutions, we want to help set your small business up for success, and we can help you establish a merchant account that will work for you.

Has “The Future” of Payments Arrived?

For those of you watching your memes and social networks, this week marked Back to the Future Day, that October day in 2015, when Marty McFly travels from 1985 to try and right the future (and then the past) in Back to the Future II.

Credit Offices Going through Changes, Difficulties

Your FICO score: As an individual, it determines your “creditworthiness.” Your personal score can even sometimes affect getting business credit, in the early days of a start-up. And of course, it affects the degree to which your customers can open new accounts, or the degree to which they’re charged to keep using current ones.

Starting a New Business? You Need a Merchant Account

When starting a new business, you need to establish a merchant account that will allow you accept and process payments.…

Back to the Breach — or “Who Watches the Watchmen?”