The New Year’s cusp is always a good time for looking both forwards – -and backwards. Especially when one considers how fast the whole passing parade… passes by! For some colorful holiday reading about the history of credit cards, we refer you this article by Bloomberg, on a Christmas-season “fiasco” occasioned by Chicago banks, getting into the then-new credit card biz.

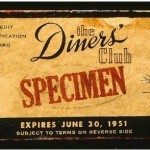

There’s some fascinating background there. Those of you old enough to remember may recall Visa’s predecessor, “BankAmericacard,” which was introduced in the late 50’s by, well, Bank America, to test the credit card waters then being plumbed by Diners Club, but few others. Believe it or not, with their initially limited uses, credit cards didn’t strike most banks as a profitable sideline until at least the mid-60’s. Then a flurry of banks rushed to get involved.

Again, it’s hard to recall an era when there were fairly strict regulations on banks — once upon a time, they couldn’t bundle up weak mortgages with bad ones! — and in those days, even having subsidiary branches was strictly limited (never mind the far-futuristic ideas of virtual wallets or online shopping!).

Again, it’s hard to recall an era when there were fairly strict regulations on banks — once upon a time, they couldn’t bundle up weak mortgages with bad ones! — and in those days, even having subsidiary branches was strictly limited (never mind the far-futuristic ideas of virtual wallets or online shopping!).

The article recounts how a lot of downtown Chicago banks decided, then, to simply send rafts of unsolicited credit cards to new customers in the suburbs, who might otherwise not physically come into the bank. And in those days, remember too that these were “live” cards — there was no activation pin to use via phone call or online check-in.

Many of those live, usable cards, then, were eventually scooped up by crooks, who raided mail boxes and and mail piles, and the resultant fraud led to a lot of credit card reform which we still abide by, today.

But the larger lesson may be that change –as in other businesses — is the only constant. And in the year ahead, your customers will be getting more acclimated to mobile processing, their aforementioned virtual wallets, and more, and it will be important to “meet them where they live,” so to speak. But of course with more foresight than those overly-enthusiastic Chicago banks did!

Contact your AVPS rep to find out what changes you might want to make in 2013, what you can do to make things more convenient for current customers, and ways to attract new ones!

This is our last blog post of the year, and we wish you all happiness for the year ahead! May the memories you take with you be the uplifting, and soul-burnishing ones!

See you after the calendar change!