Unfortunately, we have more “breaching” to report this week: As Reuters reports, “hundreds of millions of hacked user names and passwords for email accounts and other websites are being traded in Russia’s criminal underworld.”

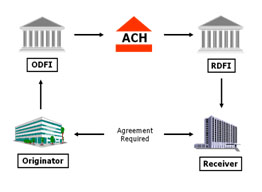

Email Breaches, the Connection to Same-Day ACH and a little “PCI”