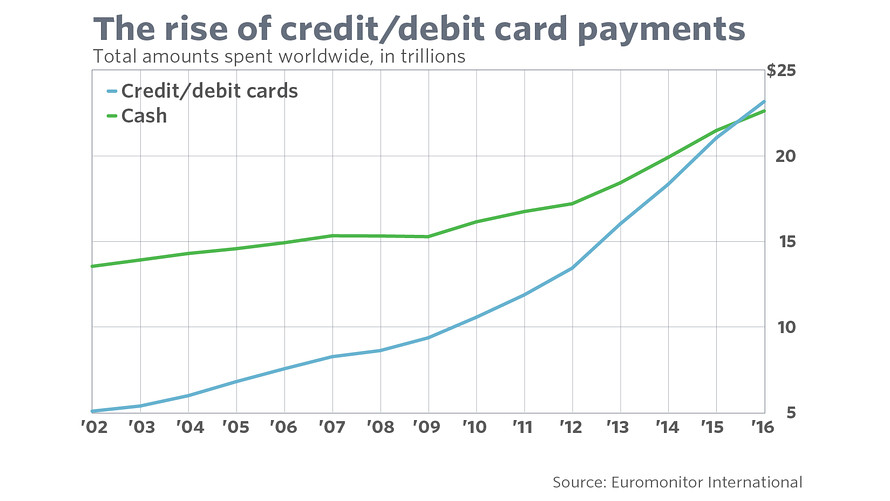

“Is this the beginning of the end for cash?,” a recent article in Marketwatch asks. No, we’re not talking about governments yanking currency and forcing everyone into an electronic payment system. Rather, we’re talking about a shift in the use of payment cards that “has happened gradually over the last 20 years, ‘dramatically skewing in favor of card and electronic payments,’” according to the same article.

What they meant, according to a similar piece in USA Today, was “new research released Tuesday by Euromonitor International, (saying) payments made using credit, debit, charge and other cards will overtake cash payments worldwide for the first time in 2016, registering $23.1 trillion in consumer spending compared with cash’s $22.6 trillion. Both numbers are up year over year, with card spending rising from $21.4 trillion globally and cash spending up from $21.8 trillion.”

Much of the growth was fueled by use of debit cards, according to Euromonitor, as they noted “the number of (debit) cards in circulation jumped 8.1% to roughly 10.1 billion cards… Credit card circulation also rose, but not by as much, up 5.3% globally year over year to 2.7 billion cards. In China, 65% of card payments were made by debit, with more than 5.4 billion cards in circulation. By comparison 35.7% of card payment spending in the U.S. this year was done via debit card, with 454.9 million cards in circulation.”

Much of the growth was fueled by use of debit cards, according to Euromonitor, as they noted “the number of (debit) cards in circulation jumped 8.1% to roughly 10.1 billion cards… Credit card circulation also rose, but not by as much, up 5.3% globally year over year to 2.7 billion cards. In China, 65% of card payments were made by debit, with more than 5.4 billion cards in circulation. By comparison 35.7% of card payment spending in the U.S. this year was done via debit card, with 454.9 million cards in circulation.”

As the Marketwatch overview notes, “using credit cards and online payments can make spending easier, which can lead to budgeting problems for some consumers, and can send them into financial trouble,” but USA Today’s wrap-up says it’s those very increase in online purchases that helps account for the ongoing raise in card use: “A study released in June by UPS and research firm ComScore found that 51% of U.S. purchases were made online, up from 48% in 2015. Debit and credit cards, of course, are required for making purchases online, but also when using mobile wallet apps such as Apple Pay, Samsung Pay and Android Pay.”

Overall though, as Marketwatch reminds readers, “cash is still used for about 85% of transactions worldwide, but that can mostly be attributed to the popularity of using cash for small transactions.”

The trend toward plastic is expected to keep growing, however — especially as younger consumers, already comfortable with a slew of “non-cash” payment options — continue to age into higher-income (and higher-spending) age brackets.

Online spending will grow as well, most immediately, this fall and winter, during the holiday season, with “black Friday,” “Cyber Monday,” and beyond.

Don’t get left behind by your own customers! See AVPS for any needed upgrades or overviews you might need, whether it’s for EMVs, mobile processing, or anything else.

And we’ll see you in October, with more news, and a few treats.